- Education

- About Forex

- How to Trade News in Forex

How to Trade News in Forex

Are you curious about how traders use news to their advantage in the foreign exchange market? Look no further than this article from.

Forex trading is a complex and dynamic process that requires traders to stay up-to-date with global news events. By keeping an eye on economic and political news, traders can anticipate market movements and capitalize on opportunities.

Many traders are practicing currency news trading strategy, which has its nuances. In this article, you'll learn about the different types of news that traders watch, and how they use that information to make profitable trades.

KEY TAKEAWAYS

- Forex trading is a complex and dynamic process that requires traders to stay up-to-date with global news events.

- Trading the news in forex involves buying or selling currency pairs based on the release of economic news or data that is expected to impact the exchange rate.

- News and events can have a significant impact on the forex market.

- Forex news trading strategies involve taking positions based on the release of economic news or data, which can cause significant movements in currency prices.

How to Trade News in Forex

Trading the news in forex involves buying or selling currency pairs based on the release of economic news or data that is expected to impact the exchange rate. This strategy can be highly profitable, but it also carries a high degree of risk.

Here are some steps to consider when trading the news in forex:

1. Identify the News Events

The first step is to identify the news events that are likely to move the markets. This can include economic indicators such as GDP, inflation, employment data, and interest rate decisions.

2. Choose the Currency Pair

Once you have identified the news event, choose the currency pair that is most likely to be impacted by the news. For example, if you are trading the US Nonfarm Payrolls data, the USD currency pairs like USD/JPY, USD/CHF, and EUR/USD are likely to be affected.

3. Analyze the Market

Before the news event, analyze the market to determine the trend and potential price movements. This will help you decide whether to buy or sell the currency pair.

4. Place the Trade

Once you have analyzed the market, place the trade. You can either buy or sell the currency pair depending on your analysis and the news event.

5. Manage your Risk

Trading the news can be risky, so it is important to manage your risk. You can use stop-loss orders to limit your losses if the trade goes against you.

6. Monitor the Trade

Once the trade is placed, monitor it closely. The news event can cause significant price movements, so be prepared to close the trade quickly if necessary.

Remember that trading news can be challenging, as markets can react quickly and unexpectedly to new information. It is important to have a solid understanding of the underlying market and asset being traded, as well as the potential impact of the news on that market. Traders also need to be able to react quickly to new information and adjust their trading strategies accordingly.

Start forex trading with IFC Markets - download MetaTrader 4, if any questions should arise please contact our support team, we are always happy to help.

News Affecting Forex Market

News and events can have a significant impact on the Forex market. Here are some of the most important types of news traders should follow when practicing currency news trading:

Economic Data Releases

Let's say that the United States releases strong employment figures, indicating that the job market is improving. This could lead to an increase in demand for the US dollar as investors become more optimistic about the US economy, leading to a higher USD exchange rate.

Conversely, if the US releases weaker than expected GDP figures, this could lead to a decrease in demand for the USD, causing its exchange rate to decline.

Central Bank Policy Decisions

If the European Central Bank (ECB) announces that it is increasing interest rates, this could lead to an increase in demand for the euro, as investors seek higher yields.

This could cause the EURUSD exchange rate to rise. Conversely, if the ECB announces that it is cutting interest rates, this could lead to a decrease in demand for the euro, causing its exchange rate to decline.

Geopolitical Events

Let's say that the United States and China enter into a trade war, with both countries imposing tariffs on each other's goods. This could lead to a decrease in demand for both the US dollar and the Chinese yuan, as investors become more risk-averse and seek safe-haven assets such as gold. This could cause the USDCNY exchange rate to decline.

Natural Disasters

If Japan is hit by a major earthquake that disrupts its manufacturing and export industries, this could lead to a decrease in demand for the Japanese yen as investors become more pessimistic about the Japanese economy. This could cause the JPYUSD exchange rate to decline.

Market Sentiment

Let's say that the European Union (EU) is facing a major political crisis, with several member states threatening to leave the union. This could lead to a decrease in demand for the euro as investors become more concerned about the stability of the EU and its currency. This could cause the EUR/USD exchange rate to decline.

On the other hand, if the EU announces a major economic reform package aimed at increasing economic growth and stability, this could lead to an increase in demand for the euro as investors become more optimistic about the EU's economic prospects. This could cause the EUR/USD exchange rate to rise.

In both of these examples, market sentiment plays a significant role in determining currency prices. Investors' perceptions of the political and economic landscape can have a significant impact on demand for currencies, which in turn affects their exchange rates.

Forex News Strategy

Forex news trading strategies involve taking positions based on the release of economic news or data, which can cause significant movements in currency prices. Here are a few common forex news trading strategies:

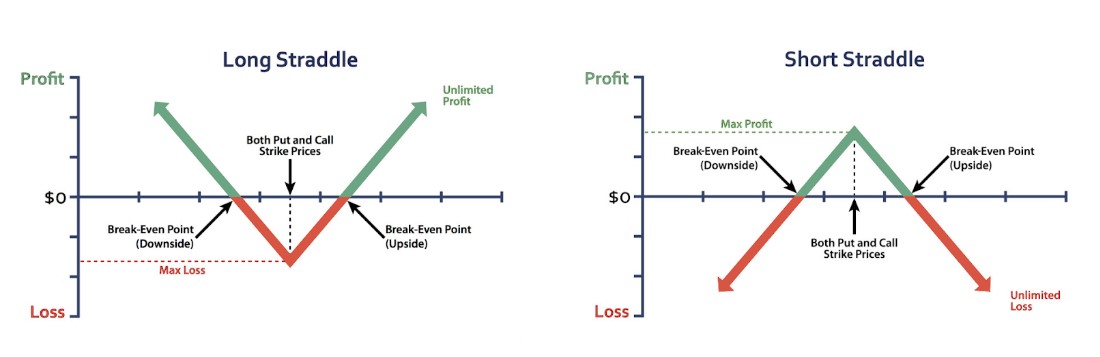

Straddle Strategy

This is a common forex news trading strategy that involves placing two pending orders, a buy order and a sell order, above and below the current price of a currency pair. This is done in anticipation of a significant price movement following the release of economic news or data. When the news is released, the price is likely to move in one direction, triggering one of the orders while canceling the other.

The advantage of this strategy is that it allows traders to take advantage of price movements without having to predict the direction of the movement. However, it's important to note that this strategy requires precision in setting the orders and execution speed, as slippage can be a risk.

Breakout Strategy

This strategy involves placing pending orders above and below a key support or resistance level. When the news is released and the price breaks through this level, the pending order is triggered and a trade is entered.

The advantage of this strategy is that it allows traders to take advantage of significant price movements while minimizing risk. However, traders should be careful to set their stop-loss orders properly in case the price retraces back to the previous level.

News Fade Strategy

This strategy involves trading against the initial market reaction to a news release. For example, if a positive economic data release causes a currency pair to rise rapidly, a trader may look to sell the pair in anticipation of a potential reversal.

The advantage of this strategy is that it allows traders to take advantage of market overreactions to news releases. However, traders should be cautious and wait for confirmation of a potential reversal before entering the trade, as the price may continue to rise or fall.

Momentum Strategy

This strategy involves trading in the direction of the initial market reaction to a news release. For example, if a positive economic data release causes a currency pair to rise rapidly, a trader may look to buy the pair in anticipation of further gains.

The advantage of this strategy is that it allows traders to take advantage of strong market momentum following a news release. However, traders should be cautious of potential retracements and set stop-loss orders properly to manage risk.

Overall, each forex news trading strategy has its advantages and risks. Traders should choose a strategy that fits their trading style and risk tolerance, and also keep in mind the importance of risk management. It's also important to stay up to date on economic news releases and their potential impact on the forex market.

As you delve into the exciting world of trading, you'll come across a plethora of forex trading strategies to explore. With careful study and practice, you'll be able to curate your own unique approach that perfectly complements your personal trading style. So, get ready to unleash your creativity and start crafting a winning strategy!

Bottom Line on How to Trade News in Forex

Overall we’ve learned:

- One key type of news that forex traders pay attention to is economic data releases. These include reports on unemployment, inflation, GDP, and other economic indicators. Traders use this information to predict how a country's currency will perform in the market. For example, if the unemployment rate is high, it may signal a weaker economy, and traders might sell that country's currency in anticipation of a decline in value.

- Another type of news that can influence the forex market is political events. Elections, changes in government policy, and international conflicts can all impact currency values. Traders watch political news closely and adjust their positions accordingly. For example, if a country's new government is more business-friendly, traders might buy that country's currency in anticipation of economic growth.

- In addition to economic and political news, traders also monitor central bank announcements. Central banks play a crucial role in setting interest rates, which can have a significant impact on currency values. When a central bank announces a change in interest rates, traders react quickly, adjusting their positions to take advantage of the new market conditions.

- While news events can provide valuable insights for forex traders, it's important to remember that the market is highly unpredictable. Even the most well-informed traders can be caught off guard by unexpected events. That's why it's essential to have a solid trading plan in place and to manage risk carefully.

In conclusion, if you're interested in forex trading, it's essential to keep up with global news events. By staying informed about economic data releases, political developments, and central bank announcements, traders can anticipate market movements and make profitable trades. But remember, forex trading is always risky, and success depends on careful planning and risk management.