- Education

- About Forex

- Forex Trading Canada

Forex Trading Canada

The Canadian foreign exchange market is well developed and stable. There is healthy competition between large brokers in the Forex market.

Trading in the financial markets has become an integral part of society's investment philosophy and is well-received by Canadian consumers. Most forex brokers offer a wide range of assets available for trading CFD assets.

Total turnover of forex trading Canada transactions rose from US$2.3 trillion in April 2019 to over US$3.4 trillion in April 2022, an increase of 50 percent.

The market has stabilized over the past few years. Brokers are now focused on developing new instruments for successful trading, as well as providing better customer service.

KEY TAKEAWAYS

- Trading in the financial markets has become an integral part of society's investment philosophy and is well-received by Canadian consumers.

- In Canada the low limits leverage and margin levels to 50:1 when forex trading in Canada.

- The CAD is most affected by the domestic economy, which is mainly dependent on exports of oil, gas and mining.

- Forex trading in Canada is highly regulated with several trusted brokers and platforms available to retail investors.

Is Forex Trading Legal in Canada

If you are wondering whether Forex Trading is legal In Canada. The answer is Yes.

The Canadian Securities Regulatory Authorities (CSA) perform financial regulatory functions for all markets. And (IIROC), which was established in 2008 under the Investment Industry Regulations of Canada, focuses on the retail Forex market. However, there are also separate rules and regulations at the provincial level, which means that brokers must comply with two sets of laws.

There are three provincial agencies that regulate forex trading in Canada:

- Toronto – Ontario Securities Commission

- British Columbia – British Columbia Securities Commission

- Montreal & Quebec – Autorité des Marchés Financiers

Over the past few years, IIROC and local regulators have been working towards regulatory harmonization. However, contradictions and inconsistencies still remain.

Canada is part of the Commonwealth of Nations, but unlike the UK or Australia, Canadian regulators are more conservative in their approach to the investment industry; trading is fairly conservative with regards to leverage.

Leverage is a Delicate Point in Forex Trading in Canada

In Canada the low limits leverage and margin levels to 50:1 when forex trading in Canada.

A lower margin rate equates to a higher leverage ratio. For example, a 2% margin rate would work out as a leverage ratio of 50:1, allowing traders to take a $50 position with a $1 margin. In contrast, a 3% margin equates to a 33:1 leverage ratio.

What is Forex Trading In Canada

Forex traders in Canada seek to profit from price movements in the international currency markets.

Online forex brokers, for their part, contribute to this, namely, they provide access to the market through trading accounts and platforms where traders can analyze and open positions, and so on.

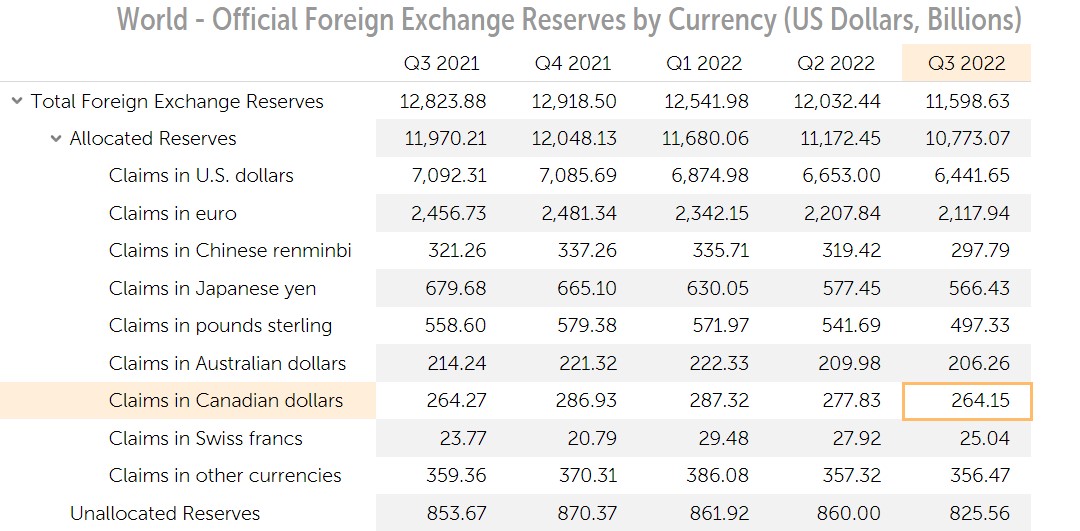

The Canadian dollar is the 6th most traded currency and forms approximately 2% of the world's foreign exchange reserves held in banks.

The CAD is most affected by the domestic economy, which is mainly dependent on exports of oil, gas and mining.

With this in mind, forex traders should pay special attention to crude oil and gold prices, which directly affect the value of the Canadian dollar.

There are important points we would like to draw your attention to

How to Choose a Good Forex Broker for Canada

There are a few things to look out for when looking for a reliable Canadian forex broker. A good way to start is to check if the brokerage is regulated locally to ensure that it meets the relevant security and transparency policies.

You should also evaluate spreads and potential commissions to make sure the trading conditions are competitive enough. A wide range of markets and trading instruments is another desirable feature of a good Canadian-friendly brokerage.

Do all Provinces in the Country Follow the Same Regulatory Framework for Trading

The short answer to this question is no. The country does not have a single regulatory framework as each province or territory in Canada regulates this sector locally. This creates inconsistencies within different provinces.

Leverage Restrictions

The maximum allowed leverage is between 45:1 and 50:1, depending on the brokerage company and the type of instrument you are trading. Just keep in mind that leverage is associated with increased volatility, so you'd better refrain from trading leveraged products until you've gained enough knowledge and experience.

I am New to Trading. Where Can I Practice to Gain Experience

All reputable Canadian brokerages provide new clients with the opportunity to practice and test their platforms through demo accounts. The latter are funded by free loans and usually remain active for a limited time, but the exact time frame varies between brokers. We strongly recommend that you refrain from investing real money in leveraged derivatives such as CFDs until you have gained sufficient experience.

The Most Popular Currency Pair Among Forex Traders from Canada

There is no definitive currency pair, but nevertheless, many Canadian traders prefer USDCAD trading, which is commonly referred to as the "looney". The pair accounted for 4.4% of all daily forex trading back in 2019.

Since the main export commodity in the Great White North is oil, the price of the Canadian dollar is closely linked to the price of oil. If oil prices fall, the dollar, in turn, weakens and the Canadian dollar strengthens. If you want to trade this currency pair, we recommend that you keep a close eye on the price of Brent crude oil and US oil.

Forex Trading Taxes in Canada

Trade taxes in Canada are divided into two categories. The former is subject to capital gains tax, the second most applicable to day traders concerns business income.

We will consider the second category as it concerns specifically Forex intraday traders.

As a day trader of any kind, you aim to close any positions by the end of the trading day. Traders seek to profit from small price movements with a large number of trades for such renegade scalpers.

Since your main goal is to make a profit (i.e. you don't hold long-term assets in search of value, you just earn money), you should report your income as business income. That income is then fully taxed at your marginal rate. It's actually pretty straight forward when you think about it.

Advantages

Loss deduction. As a day trader, you cannot use the 50% rate of including capital gains in your profits. However, you can deduct 100% of your trading losses from other sources of income. So let's say you made $100,000 in trading losses this tax year.

However, you also have a consulting business. You can offset your trading losses with the income generated from your consulting business. Trading losses are offset by other business income, end of story.

Expense Statement

You can also claim reimbursement for expenses related to your trading activities. Think about the cost of software, internet connection, your new trading laptop, data transfer costs, etc.

However, to be able to claim any Canadian day trader tax deductions, you must have receipts for all items claimed on return. The Canadian Revenue Agency (CRA) will not accept these deductions without receipts, and you must also be able to justify how each purchase involved trading activities.

Canadian Forex Trading

First of all, as a Canadian forex trader, you should ask yourself what drives the price of the Canadian dollar?

The price of the Canadian dollar is influenced by a number of fundamental factors that affect the supply and demand for the currency.

Monetary Policy

When central banks seek to curb excessive inflation, they often consider raising interest rates to encourage the economy to save more than spend and reduce the rise in prices of goods and services. In turn, higher interest rates attract foreign investment, in this case increasing the demand for the Canadian dollar and raising its value against other currencies.

Oil Prices

Oil prices are closely linked to the strengthening of the Canadian dollar, especially in the USD/CAD currency pair, due to Canada's status as one of the world's largest oil producers and pricing of this commodity in US dollars. When a large amount of oil flows from Canada to the US, demand is created for Canadian dollars, which leads to a rise in the CAD and often a decline in the USD/CAD pair.

The high oil price also means higher Canadian dollar export earnings, which also boosts the Canadian dollar. Conversely, lower demand and lower prices reduce the inflow of the US dollar into Canada, lowering the value of the Canadian dollar and having a bullish effect on the USD/CAD pair.

An example of this was the collapse in oil prices in March 2020, when the Canadian dollar, in turn, fell against a number of currencies.

Of course, the balance of trade covers a range of other commodities as well as commercial and manufactured goods, so traders interested in CAD should keep abreast of how other key Canadian sectors develop over time.

Economic Data Releases/News Events

Data releases are capable of conveying fundamental information that can inspire traders to take positions in certain currencies. For example, inflation as measured by the consumer price index can affect interest rates, as discussed above, meaning that traders can expect rapid inflation to cause rates to rise, resulting in more demand for CAD.

Other metrics to watch out for are sentiment, which shows whether traders are net or short, consumer confidence, which can be a guide to the direction of the economy, retail sales, services, and manufacturing business activity indexes, and GDP itself - the ultimate measure of economic activity.

Popular Currency Pairs Traded in Canada

USD/CAD Pair

This pair is consistently among the top 10 most traded currency pairs in the world, and as such, traders can count on good liquidity and tight spreads.

Since the pair is linked to both the US and Canadian economies, traders should be aware of developments that could affect each, such as the policies of the Federal Reserve and the Bank of England, and interest rate differentials between central banks. Also, due to the CAD's correlation with commodities like oil and its USD pricing, it's useful to watch the price of oil to see where the USD/CAD might go next.

EUR/CAD Pair

EUR/CAD is not among the top ten most traded pairs and is less liquid than major pairs such as USD/CAD. However, it can be more volatile than many major currencies, leading to potentially profitable moves – and also, of course, commensurate risk. As with all CAD pairs, traders should be mindful of the impact of oil prices, as well as European Central Bank meetings in addition to the Bank of England meetings.

AUD/CAD Pair

This pair is less liquid than the major pairs and can also fluctuate a lot. Although Australia and Canada do not trade much with each other, they both have the status of commodity currencies, which means that the strength of each currency can be affected by supply and demand patterns in the respective country and relations with their trading partners.

Note: Any trader before starting trading has to research the forex broker he would like to work with. To understand the process of choosing a “Canadian forex broker”, we invite you to read this article.

Bottom Line on Forex Trading Canada

You need to know that Forex trading in Canada is highly regulated with several trusted brokers and platforms available to retail investors. You also need to be aware of the limitations of leverage ratios and the relatively high tax liability. For beginners, use online training courses and demo accounts. Well, and tax obligations when trading on the Forex market in Canada.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.