- Analisi

- Analisi Tecnica

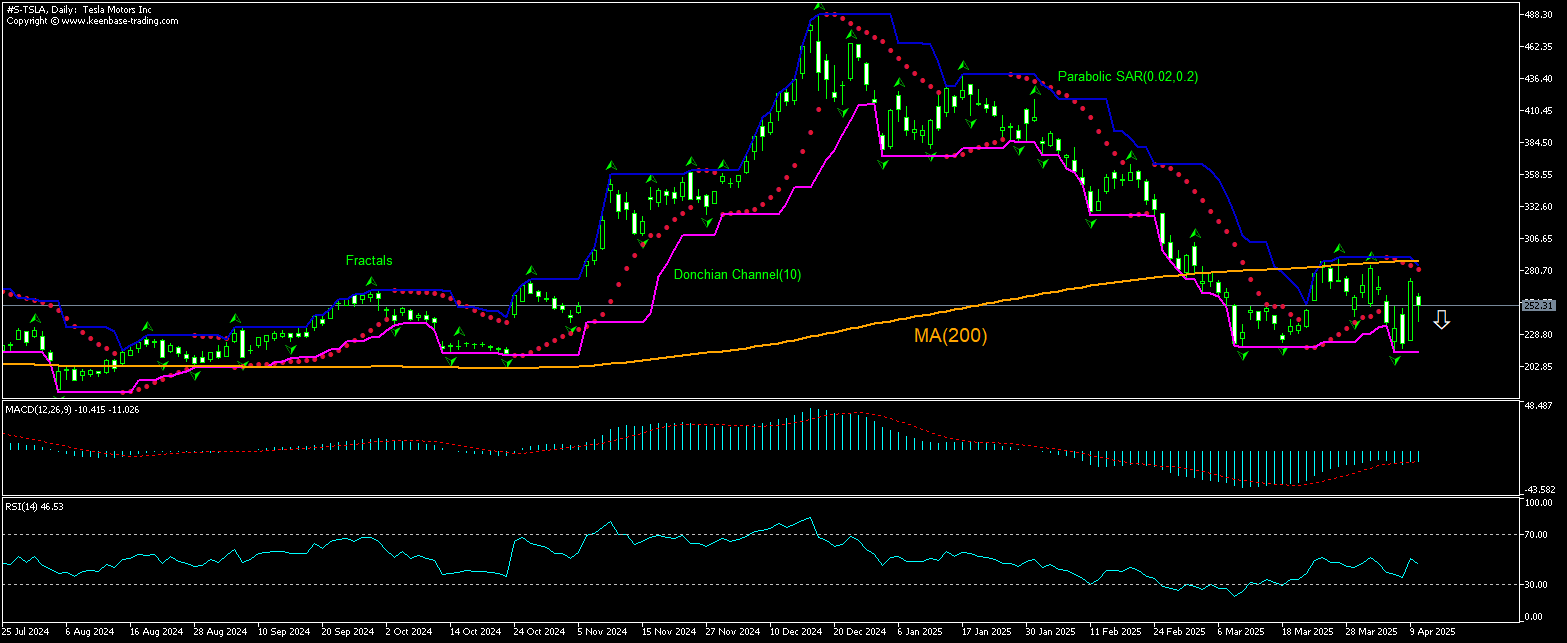

Tesla Motors Inc. Analisi Tecnica - Tesla Motors Inc. Trading: 2025-04-11

Tesla Technical Analysis Summary

Sotto 214.09

Sell Stop

Sopra 274.38

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Buy |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Tesla Chart Analysis

Tesla Analisi Tecnica

The technical analysis of the Tesla stock price chart on daily timeframe shows #S-TSLA,Daily is retracing down after testing the 200-day moving average MA(200). We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 214.09. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 274.38. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (274.38) without reaching the order (214.09), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Azioni - Tesla

Tesla stock is in decline since president Trump ordered steep tariffs on import from Chinas. Will the Tesla stock price continue retreating?

Tesla has suspended taking new orders for two imported models - Model S and Model X vehicles on its Chinese website. Both models are assembled in Tesla’s factories in Fremont, California, and Tilburg, Netherlands, and are exported to China. While no information has been released for the reason for orders suspension, Tesla CEO Elon Musk had recently said that president Trump’s steep tariffs on China - which were hiked to 145% this week- stood to “significantly” impact the EV maker. China is a major market and production hub for Tesla. New orders suspension for Model S and Model X vehicles in China is bearish for Tesla stock price.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.